🗣 SL提问: Arbitrage

✍️ Ai批改: Arbitrage refers to the practice of taking advantage of a price difference between two or more markets to earn a profit、In the context of finance, arbitrage involves exploiting price inefficiencies in different markets to generate risk-free profits、Here's a comprehensive overview:

Types of Arbitrage:

1、Simple Arbitrage: This involves buying an asset at a lower price in one market and selling it at a higher price in another market.

2、Risk Arbitrage: This involves buying and selling similar assets in different markets to profit from price discrepancies.

3、Statistical Arbitrage: This involves using mathematical models to identify mispricings in the market and profit from them.

4、Merger Arbitrage: This involves buying shares of a company being acquired and selling them at a higher price after the acquisition is completed.

Examples of Arbitrage:

1、Currency Arbitrage: Buying a currency at a lower exchange rate in one market and selling it at a higher exchange rate in another market.

2、Stock Arbitrage: Buying a stock at a lower price on one exchange and selling it at a higher price on another exchange.

3、Commodity Arbitrage: Buying a commodity at a lower price in one market and selling it at a higher price in another market.

How Arbitrage Works:

1、Identify a price discrepancy: Find a price difference between two or more markets.

2、Buy low, sell high: Buy the asset at the lower price and sell it at the higher price.

3、Lock in a profit: The difference between the two prices is the arbitrage profit.

Arbitrage Strategies:

1、Market making: Providing liquidity to a market by buying and selling assets at prevailing market prices.

2、Pairs trading: Buying and selling similar assets to profit from price discrepancies.

3、Event-driven arbitrage: Profiting from price movements caused by specific events, such as mergers and acquisitions.

Risks and Challenges:

1、Market risk: Prices may move against the arbitrageur, resulting in losses.

2、Liquidity risk: Insufficient liquidity in one or both markets can make it difficult to execute trades.

3、Regulatory risks: Arbitrage strategies may be subject to regulatory scrutiny or restrictions.

4、Model risk: Statistical models used for arbitrage may be flawed or incomplete.

Real-World Applications:

1、Investment banks: Arbitrage is a key strategy for investment banks to generate profits.

2、Hedge funds: Many hedge funds employ arbitrage strategies to generate alpha.

3、Proprietary trading firms: These firms use arbitrage strategies to profit from market inefficiencies.

Criticisms and Limitations:

1、Market efficiency: Arbitrage can contribute to market efficiency by eliminating price discrepancies.

2、Risk-free profits: Arbitrage profits may not be entirely risk-free, as market conditions can change rapidly.

3、Regulatory scrutiny: Arbitrage strategies may be subject to regulatory oversight and restrictions.

In conclusion, arbitrage is a sophisticated investment strategy that involves exploiting price inefficiencies in different markets、While it can be profitable, it also involves risks and challenges that must be carefully managed.

0

IP地址: 81.233.158.93

搜索次数: 88

提问时间: 2025-04-11 11:08:28

❓️ 热门提问:

买卖黄金在哪开户

bt岛磁力搜索引擎

鹏华养老产业股票

跨境外汇汇款

外汇怎么样交易

安乐工程

保山珠宝鉴定去哪里做

介绍域名deepseek.center的含义、价值与适合的行业。

广州外贸营销推广公司

3d硬金容易断吗

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

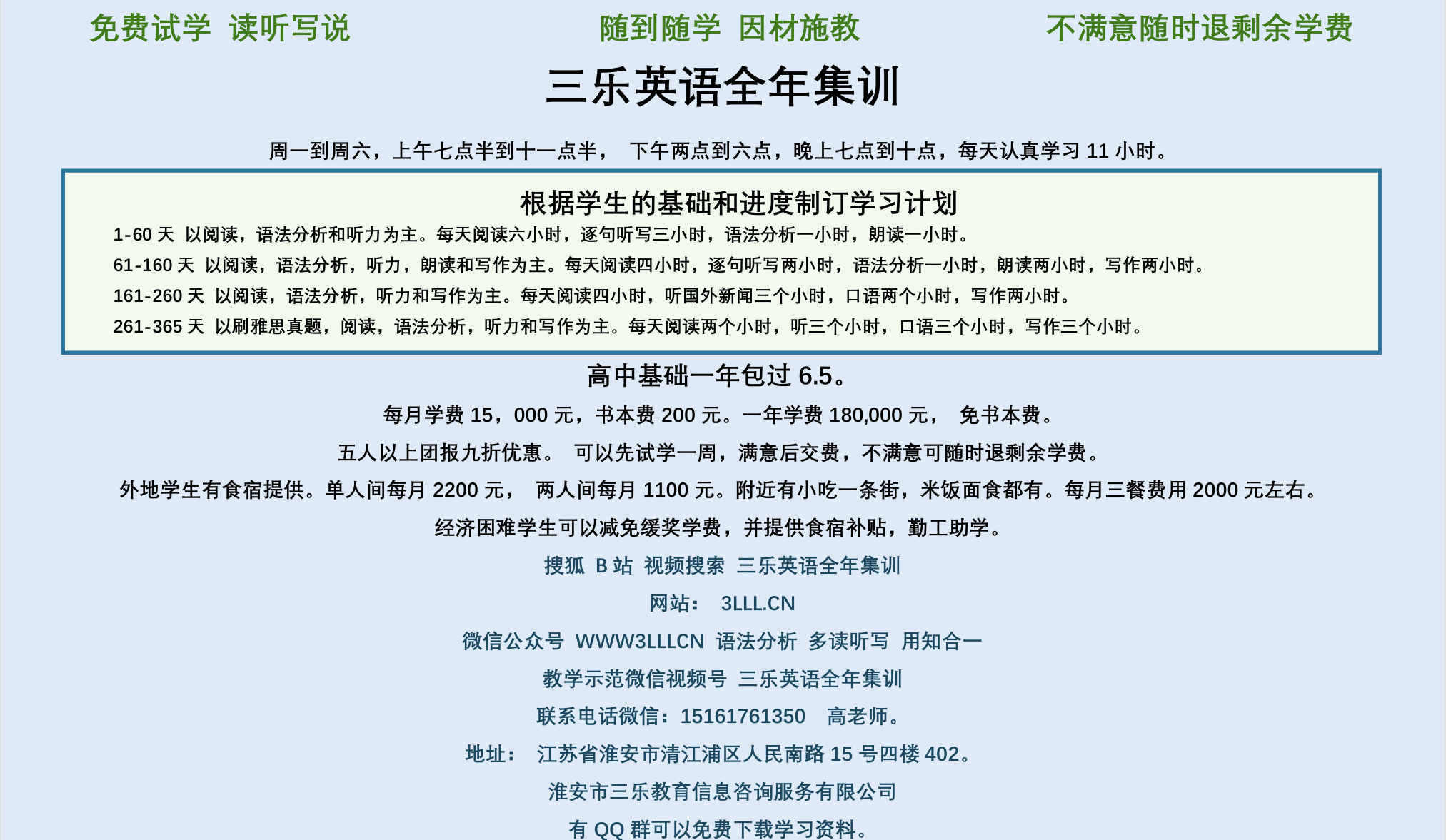

英语培训

本站流量

联系我们

🔗 友情链接:

搜索引擎导航

Buscador cubano

ai提问

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。