🗣 SL提问: 黄金现货学习

✍️ Ai批改: A great topic! Spot gold, also known as spot gold trading, refers to the immediate sale and purchase of gold for immediate delivery、Here's a comprehensive overview to get you started:

What is Spot Gold?

Spot gold is a type of gold trading where the buyer and seller agree to exchange gold for cash at the current market price, with the transaction settled immediately or within a short period (usually two business days)、This type of trading is also known as cash trading or physical trading.

How Does Spot Gold Trading Work?

In spot gold trading:

1、Market participants: Banks, trading houses, refineries, and investors participate in the spot gold market.

2、Pricing: The price of spot gold is determined by supply and demand in the market, influenced by factors like global economic conditions, interest rates, and investor sentiment.

3、Transaction: A buyer and seller agree on a price, and the buyer pays the seller the agreed-upon amount for the gold.

4、Delivery: The seller delivers the gold to the buyer, usually in the form of physical gold bars or coins.

Key Characteristics of Spot Gold Trading

1、Immediate delivery: Spot gold transactions involve immediate or near-immediate delivery of the gold.

2、Cash settlement: The transaction is settled in cash, with the buyer paying the seller the agreed-upon amount.

3、Market price: The price of spot gold is determined by market forces, reflecting current supply and demand.

Spot Gold vs、Other Types of Gold Trading

1、Spot gold vs、futures gold: Spot gold involves immediate delivery, while futures gold involves contracts with a specific delivery date in the future.

2、Spot gold vs、gold ETFs: Gold ETFs (exchange-traded funds) track the price of gold but don't involve physical ownership.

Advantages of Spot Gold Trading

1、Physical ownership: Spot gold trading allows for immediate ownership of physical gold.

2、No counterparty risk: Since the transaction is settled immediately, there is no risk of default by the counterparty.

3、Flexibility: Spot gold trading can be done in various quantities, from small to large amounts.

Disadvantages of Spot Gold Trading

1、Storage and security: Physical gold requires secure storage, which can be costly and inconvenient.

2、Transaction costs: Spot gold trading involves transaction costs, such as brokerage fees and bid-ask spreads.

Popular Ways to Trade Spot Gold

1、Over-the-counter (OTC) trading: Direct transactions between buyers and sellers, often facilitated by banks or trading houses.

2、Online trading platforms: Electronic platforms that connect buyers and sellers, providing real-time pricing and market access.

3、Gold dealers and refineries: Specialized dealers and refineries that buy and sell gold in physical form.

Tips for Spot Gold Trading

1、Understand market prices: Stay informed about current market prices and trends.

2、Choose a reputable dealer: Research and select a trustworthy dealer or trading platform.

3、Consider storage and security: Plan for secure storage of your physical gold.

By understanding the basics of spot gold trading, you'll be better equipped to navigate this market and make informed investment decisions.

Do you have any specific questions or topics related to spot gold trading that you'd like to explore further?

0

IP地址: 82.115.77.38

搜索次数: 80

提问时间: 2025-06-23 08:57:45

❓️ 热门提问:

外贸平台有哪些免费的

世界黄金多少钱一克

如何鉴别真假黄金的简单方法

国外炒黄金平台哪个安全可靠

1吨多少克黄金

1盎司等于多少克黄金盎司与克的换算

禁止炒外汇

大成红利优选一年持有混合发起A

鸿福珠宝的黄金是真的吗

ai大模型发布会

豌豆Ai站群搜索引擎系统

🤝 关于我们:

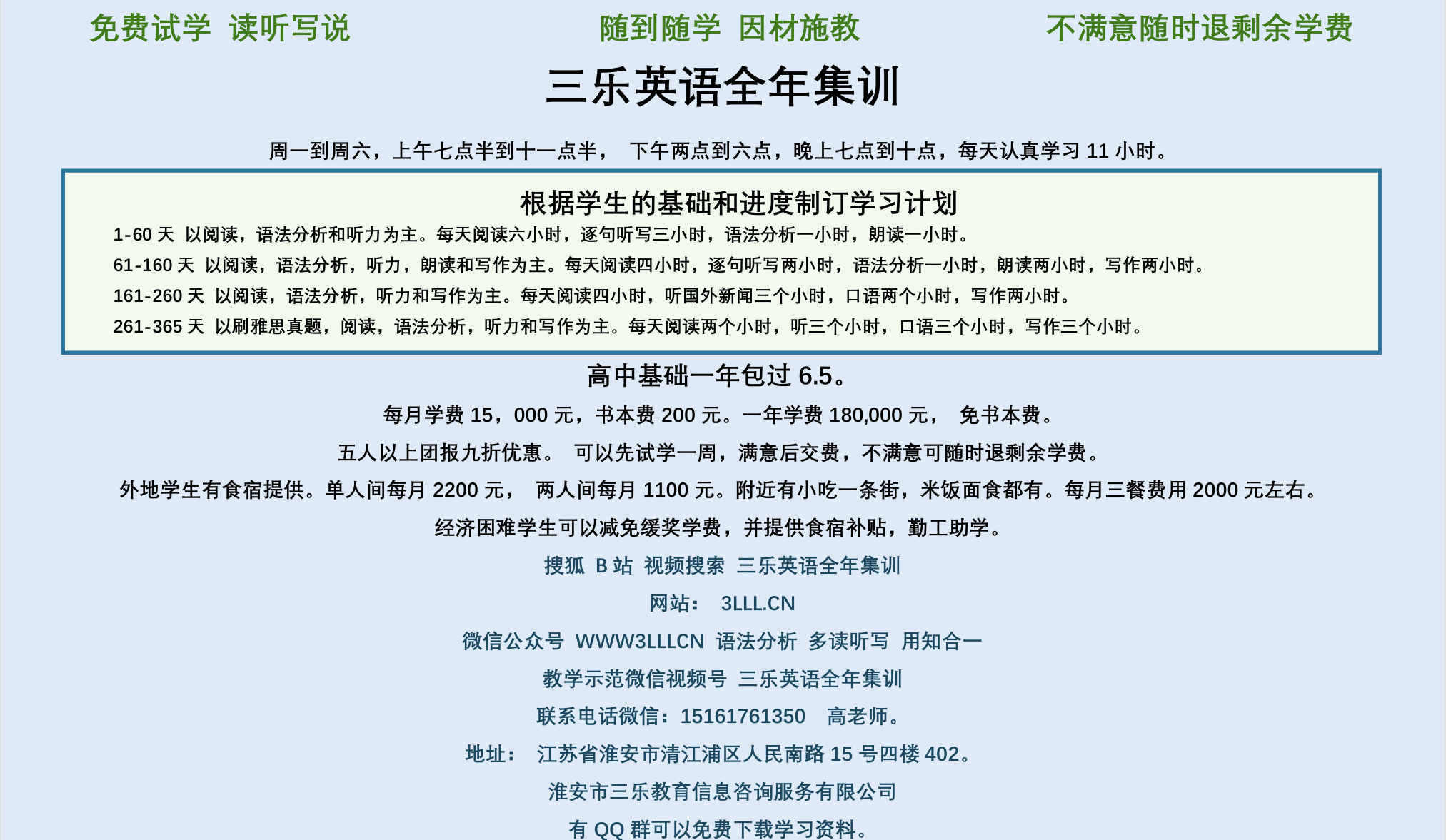

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。