🗣 SL提问: 碳中和ETF

✍️ Ai批改: A carbon-neutral ETF (Exchange-Traded Fund) is an investment fund that tracks a portfolio of companies that have a minimal or zero carbon footprint, or those that are actively working to reduce their carbon emissions、The goal of a carbon-neutral ETF is to provide investors with exposure to companies that are committed to reducing their environmental impact and transitioning to a low-carbon economy.

Here are some key aspects of carbon-neutral ETFs:

Investment strategy:

Carbon-neutral ETFs typically invest in companies that:

1、Have a low carbon footprint: Companies with lower greenhouse gas emissions compared to their peers.

2、Are transitioning to a low-carbon economy: Companies actively working to reduce their carbon emissions through sustainable practices, renewable energy, and energy efficiency.

3、Are leaders in clean energy: Companies involved in renewable energy, energy efficiency, and sustainable technologies.

Investment objectives:

The investment objectives of carbon-neutral ETFs vary, but common goals include:

1、Long-term growth: Seeking capital appreciation through investments in companies poised to benefit from the transition to a low-carbon economy.

2、Income generation: Focusing on dividend-paying companies with a commitment to sustainability.

3、Risk management: Reducing exposure to companies with high carbon footprints, which may be more vulnerable to climate-related risks.

Examples of carbon-neutral ETFs:

Some popular carbon-neutral ETFs include:

1、iShares MSCI ACWI Low Carbon Target ETF (CRBN): Tracks the MSCI ACWI Low Carbon Target Index, which includes companies with lower carbon footprints.

2、SPDR S&P 500 Carbon Footprint ETF (EFIV): Tracks the S&P 500 Fossil Fuel Free Index, which excludes companies with significant fossil fuel reserves.

3、Invesco PowerShares Global Water ETF (PIO): Focuses on companies involved in water conservation, efficiency, and sustainability.

4、First Trust Indxx Innovative Transaction & Process ETF (LEGR): Invests in companies involved in sustainable and innovative processes.

Benefits:

Investing in a carbon-neutral ETF can provide:

1、Exposure to sustainable companies: Supporting companies that prioritize environmental sustainability and social responsibility.

2、Risk management: Reducing exposure to climate-related risks and carbon-intensive industries.

3、Long-term growth potential: Capitalizing on the growth opportunities presented by the transition to a low-carbon economy.

Things to consider:

Before investing in a carbon-neutral ETF, consider:

1、Fees and expenses: Management fees, trading costs, and other expenses can eat into returns.

2、Tracking error: The ETF's performance may deviate from its underlying index or investment objective.

3、Company selection: The ETF's holdings may not perfectly align with your values or expectations.

4、Regulatory changes: Climate-related regulations and policies can impact the performance of carbon-neutral ETFs.

By investing in a carbon-neutral ETF, you can align your portfolio with your values and contribute to a more sustainable future while potentially benefiting from long-term growth and income generation.

0

IP地址: 88.171.86.172

搜索次数: 148

提问时间: 2025-04-16 05:11:16

❓️ 热门提问:

2025年1月金条价格

黄金金条的回收价格

ai x光 软件

怎么鉴定黄金是真的

灵宝黄金集团

gold是什么意思

期货黄金1手多少钱

白日梦ai创作平台

成都失业金多少钱一个月

长沙黄金上门回收

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

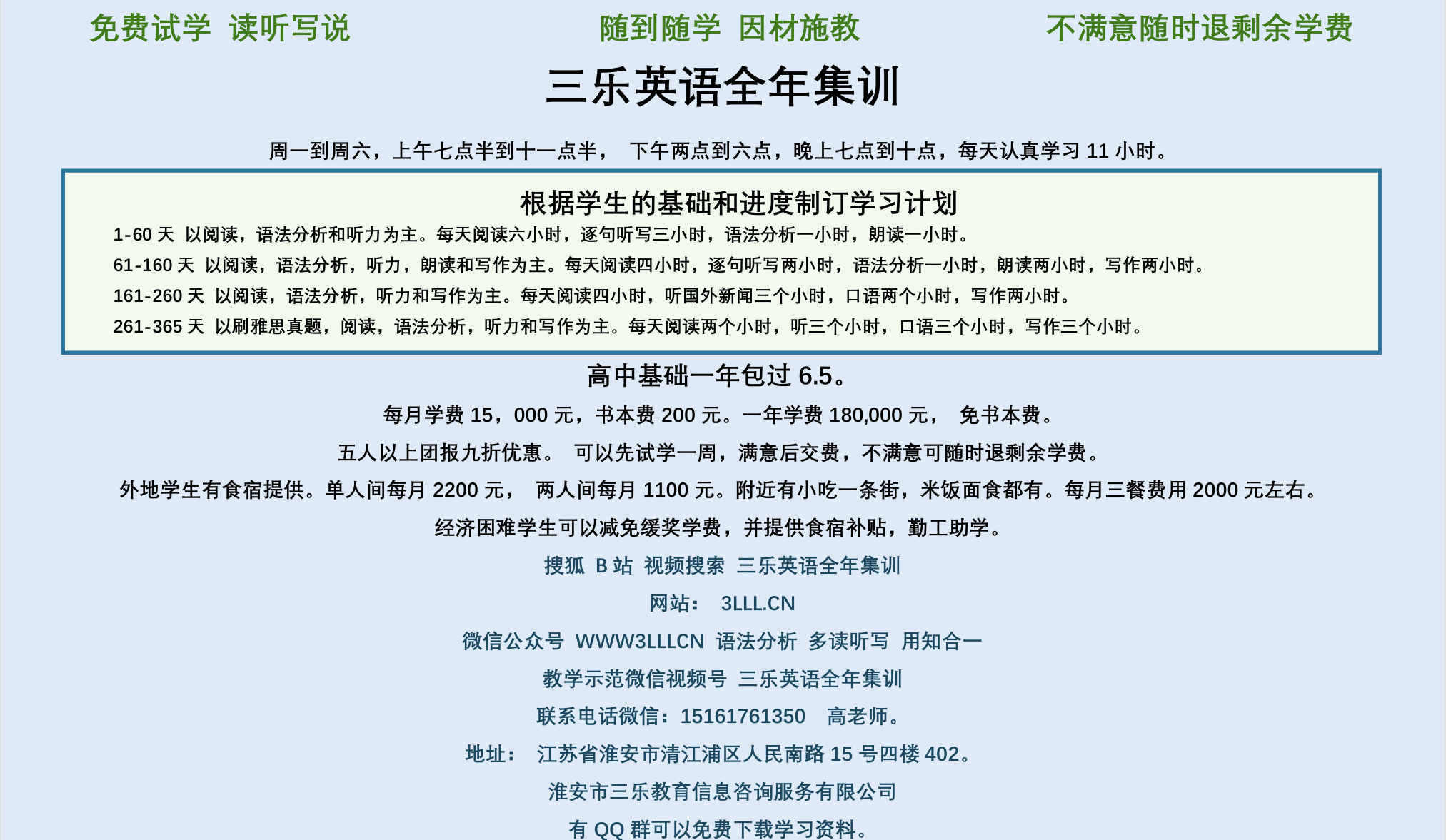

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。