🗣 SL提问: 金ETF

✍️ Ai批改: A gold ETF (Exchange-Traded Fund) is an investment fund that tracks the price of gold and is traded on a stock exchange, like other ETFs、Here's a brief overview:

What is a Gold ETF?

A gold ETF is a type of investment fund that holds gold bullion or gold-related assets, such as gold futures contracts, options, and other derivatives、The fund's goal is to track the price of gold, allowing investors to gain exposure to the metal without actually owning physical gold.

How do Gold ETFs work?

Gold ETFs work similarly to other ETFs、Here's a simplified explanation:

1、Creation: A sponsor creates a gold ETF and lists it on a stock exchange.

2、Gold backing: The ETF holds a certain amount of gold bullion or gold-related assets, which are stored in a secure vault or custodied by a third-party bank.

3、Shares issued: The ETF issues shares to investors, which represent a portion of the underlying gold holdings.

4、Trading: The shares are traded on a stock exchange, allowing investors to buy and sell them throughout the day.

5、Redemption: When an investor buys or sells shares, the ETF's sponsor redeems or issues new shares to maintain the fund's gold backing.

Popular Gold ETFs

Some of the most popular gold ETFs include:

1、SPDR Gold Shares (GLD): One of the largest and most liquid gold ETFs, with over $60 billion in assets under management.

2、iShares Gold Trust (IAU): Another large gold ETF with over $30 billion in assets.

3、VanEck Vectors Gold Miners ETF (GDX): A gold mining ETF that tracks the performance of gold mining companies.

Benefits of Gold ETFs

1、Convenience: Gold ETFs offer a convenient way to invest in gold without the need to store or insure physical gold.

2、Liquidity: Gold ETFs are traded on stock exchanges, making it easy to buy and sell shares.

3、Transparency: Gold ETFs disclose their holdings daily, allowing investors to see the underlying assets.

4、Diversification: Gold ETFs can provide a hedge against inflation, currency fluctuations, and market volatility.

Risks and Considerations

1、Market volatility: Gold prices can be volatile, affecting the value of gold ETFs.

2、Tracking error: Gold ETFs may not perfectly track the price of gold due to fees, expenses, and other factors.

3、Counterparty risk: Gold ETFs rely on custodians and other third-party providers, which can introduce counterparty risk.

4、Fees and expenses: Gold ETFs charge management fees, which can eat into returns.

Investing in Gold ETFs

If you're interested in investing in gold ETFs, consider the following:

1、Understand your goals: Determine why you want to invest in gold and how it fits into your overall investment strategy.

2、Choose a reputable ETF: Research and select a well-established gold ETF with a strong track record.

3、Monitor fees and expenses: Be aware of the ETF's fees and expenses, as they can impact returns.

4、Diversify your portfolio: Consider allocating a small portion of your portfolio to gold ETFs, as they can be volatile.

I hope this helps! Do you have any specific questions about gold ETFs or investing in gold?

0

IP地址: 122.165.205.20

搜索次数: 91

提问时间: 2025-04-14 23:21:07

❓️ 热门提问:

详细介绍域名www.5a.jx.cn的含义、价值与适合的行业。

山东黄金明天行情走势

中国十大名牌珠宝排名

微信立减金回收平台

外汇基点是什么意思

今天人民币外汇牌价表

怎么分辨黄金和铜

黄金etf 持仓量

大学生戴的黄金项链

ai方案免费

豌豆Ai站群搜索引擎系统

🤝 关于我们:

三乐Ai

作文批改

英语分析

在线翻译

拍照识图

Ai提问

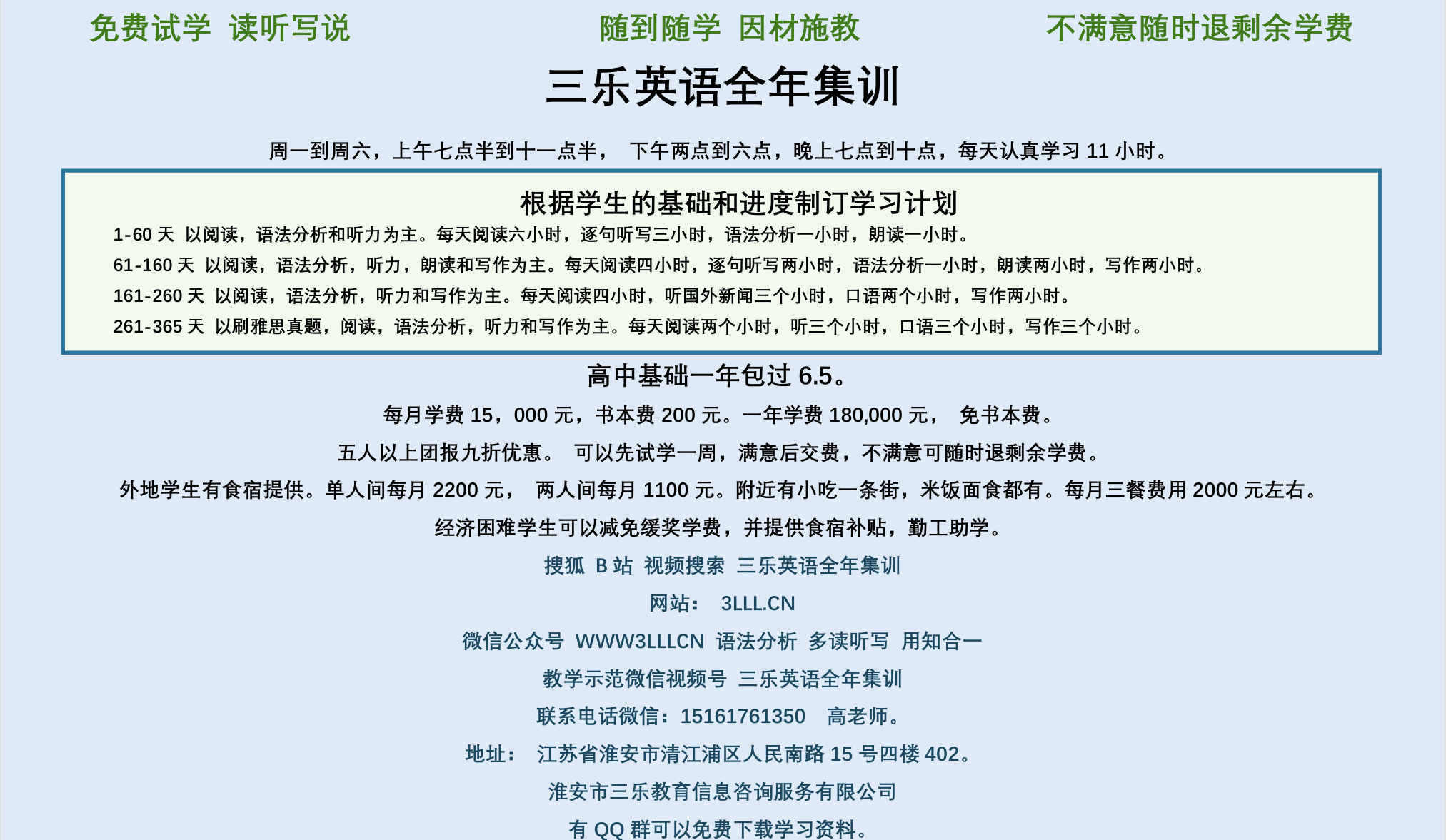

英语培训

本站流量

联系我们

📢 温馨提示:本站所有问答由Ai自动创作,内容仅供参考,若有误差请用“联系”里面信息通知我们人工修改或删除。

👉 技术支持:本站由豌豆Ai提供技术支持,使用的最新版:《豌豆Ai站群搜索引擎系统 V.25.05.20》搭建本站。